It also allows you more freedom to create a financially secure future for years to come. With a detailed budget and the information from your expense tracking, you can create customized goals such as paying down debt, saving for a rainy day, or making a large purchase.įinding the best expense tracker apps isn’t just a matter of getting a handle on your current financial situation. However, only 50% of Americans have even one month’s worth of expenses covered.įinding the best app for tracking expenses can make it easier to come up with a budget that leaves room for covering emergencies.

Experts recommend storing up at least six months’ worth of expenses in an emergency fund. Once you know where each dollar goes, you can work hard to craft a budget that redirects the dollars where you really need them.Ĭreating a budget using the information obtained from an expense tracking app can be incredibly beneficial. Most consumers likely could not identify exactly how much their family spends on these categories without making use of one of the top spending tracker apps available today.Įxpense trackers are useful tools to categorize your spending into problem areas. If you want to know what the average American spends each year on popular categories without using one of the best expense tracker apps, you can see some examples from 2015 below: Savings can often take a backseat to more pressing goals, like putting dinner on the table in just a few minutes or a stop by the coffee shop in the morning.Įxpense trackers can help you to identify exactly where you are currently spending your money and get a better handle on money management.Īccording to the annual consumer expenditure survey issued by the United States Bureau of Labor Statistics, consumers have some interesting spending habits. We are rarely willing to admit that our money does not always make it to its intended destination. Planning a Budget and Using Expense Trackers

#BEST BUSINESS EXPENSE TRACKER APP SOFTWARE#

See Also: Top Marketing Automation Software Tools | Ranking | Best Automation Tools & Platforms

#BEST BUSINESS EXPENSE TRACKER APP FREE#

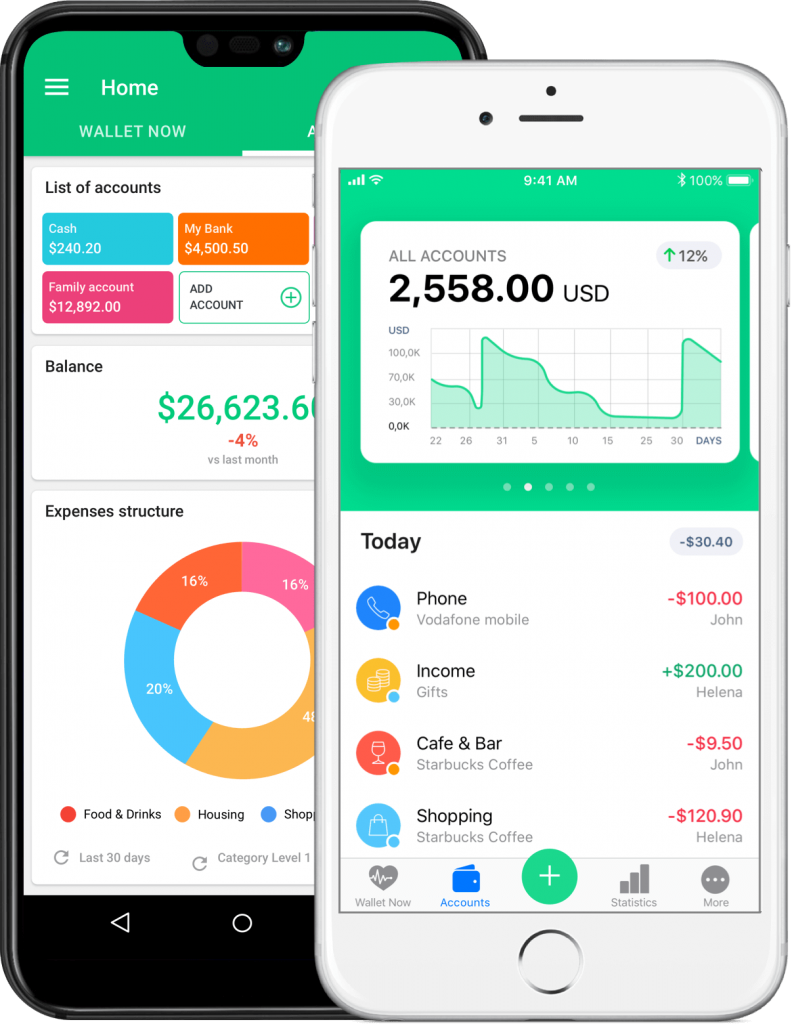

It’s an essential ability when it comes to having a healthy financial future, which is why we created this ranking of the best expense tracker apps.įrom free options to those that charge on a monthly basis, these best expense tracker apps will give you the knowledge and power you need to start working responsibly toward your end goal. Spending tracker apps give you a more realistic picture of your finances.Īward Emblem: Top 6 Best Expense Tracker AppsĪdvisoryHQ wants you to know exactly where each dollar you make is headed. Not only that, but finding the best expense tracker apps gives you the freedom to create a budget and set healthy financial goals for yourself. Expense tracking is a useful skill so you can see the long-term effects of your current spending habits.

You can see how many times you went out to eat, what you spent during afternoon shopping sprees, and what percentage of your pay is allocated toward your actual bills. With all of the data in one convenient location on an expense tracker, it becomes easier for you to categorize your spending. Expense trackers are linked to your bank account or allow you to manually enter transactions each and every time they happen. If you’ve been trying to get a better grip on the money in your bank account, a spending tracker may be able to help. What we don’t know is exactly where the rest of the money slips off to by the end of the month. Do you know where the money in your bank account goes each month? Sure, most of us would argue that it goes toward bills and necessities.

0 kommentar(er)

0 kommentar(er)